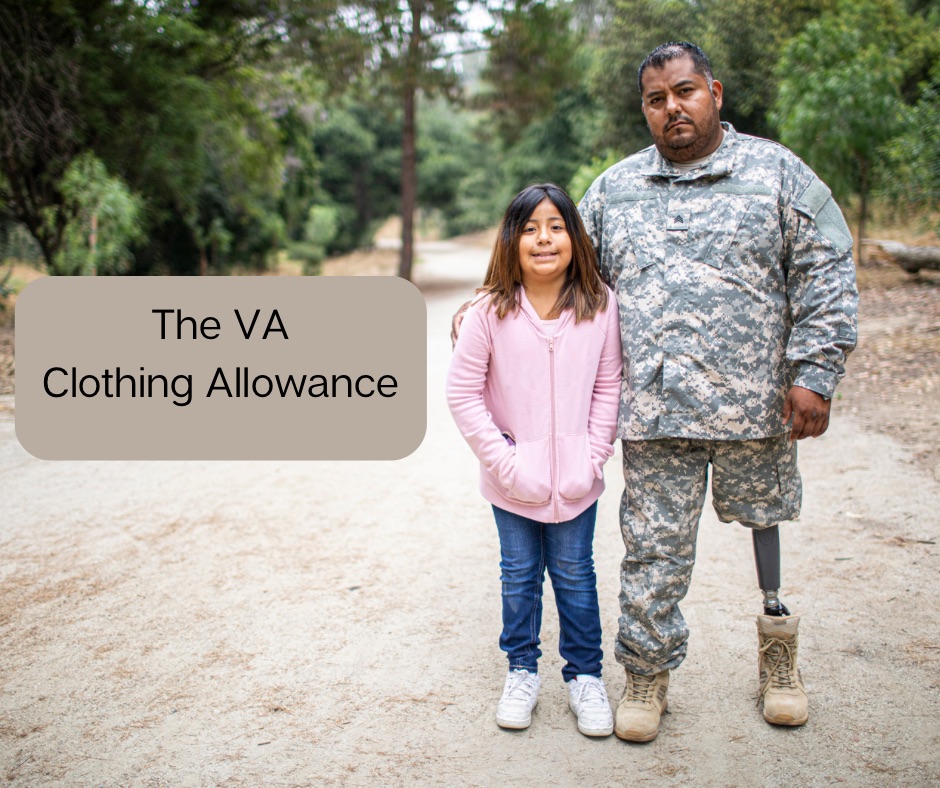

Dress with Confidence: How the VA Clothing Allowance Supports Veterans

The VA (Department of Veterans Affairs) clothing allowance is a benefit provided to eligible veterans who have service-connected disabilities that require the use of prosthetic or orthopedic devices, or who have certain skin conditions due to their military service. This allowance helps veterans cover the cost of replacing or repairing clothing that may be damaged by these devices or conditions.

The VA clothing allowance offers several important benefits to eligible veterans:

- Financial Assistance: The primary benefit of the VA clothing allowance is financial support. It provides veterans with a tax-free payment to help offset the costs associated with replacing or repairing clothing that may be damaged due to the use of prosthetic or orthopedic devices or certain skin conditions. This financial assistance can be especially valuable to veterans who may face additional expenses related to their service-connected disabilities.

- Improved Quality of Life: For veterans with service-connected disabilities that require prosthetic limbs, braces, or other devices, maintaining appropriate clothing can be challenging and costly. The clothing allowance helps improve their overall quality of life by ensuring they can afford the necessary clothing modifications to accommodate these devices comfortably.

- Promotes Independence: By providing financial assistance for clothing-related expenses, the VA clothing allowance promotes independence among veterans with disabilities. It allows them to make choices about their clothing needs without being overly burdened by costs, thus enhancing their ability to live independently.

- Annual Eligibility: Veterans can apply for the clothing allowance on an annual basis. This means that if their condition or clothing needs change over time, they can continue to receive support to address those changing requirements.

- Ease of Application: The application process for the VA clothing allowance is typically straightforward. Veterans can apply through their local VA office, and the VA reviews their eligibility based on established criteria.

- Tax-Free Benefit: The clothing allowance is provided as a tax-free benefit, meaning veterans do not have to pay taxes on the funds they receive. This further eases the financial burden on veterans and ensures they can use the full amount for their clothing needs.

It’s important for eligible veterans to be aware of this benefit and to apply for it if they meet the criteria, as it can significantly assist them in managing the costs associated with their service-connected disabilities. More information on the VA Clothing allowance can be found at this page of the VA website.